Exit Anytime

Real-time problem solving is not just about time, it's about time. This allows you to solve within a specified time problem has a solution.

Competitive Returns

By and large, credit cards are easily the most secure and safe payment method to use when you shop online. credit cards most secure.

Default Protection

The biggest benefit of offering 24/7 support is that you provide a more convenient service for your customers providing clock support.

No money upfront.

Instant Payment. Electronic payments are much faster than the traditional methods of payments.

Online invoice payment helps companies save time, are faster and save maximum effort for the clients. It also helps in reducing the excessive physical transactions.

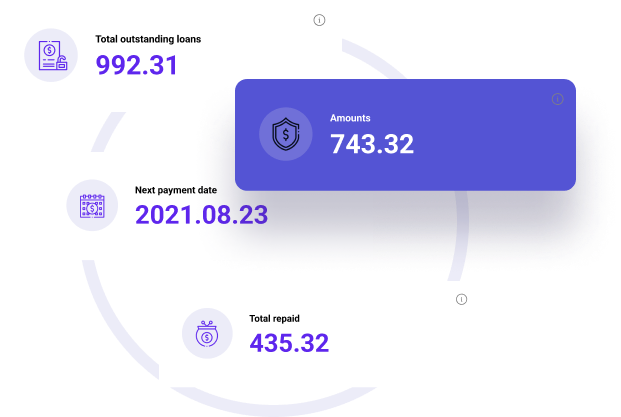

VETTED BORROWERS

Online payment companies are responsible for handling online or internetbased payment. The online payment systems.

“Simply the best. Better than all the rest. Recommend this product to beginners and advanced users.”

Trevor Lane

Director of Technology, CreativeGIG

Innovative uncollateralized lending.

1.5M

which is approximately 56% of the consumer population of the US

41%

The largest adopters due to being comfortable with technology

3964+

The online payment system offers electronic alternatives to traditional

Roadmap

Initial DEX Offering

BNPL launched with an IDO on the Thorstarter Launchpad on September 14th, followed by a Balancer Liquidity Bootstrapping Pool (LBP) on September 16th

Liquidity Mining

Holders of BNPL and ETH can provide liquidity to the SushiSwap BNPL-ETH Liquidity Pool and stake their LP tokens to earn BNPL rewards in the BNPL LP Farm

PeckShield Smart Contract Audit

DeFi security is paramount, so BNPL Pay have engaged with industry leading cybersecurity firm PeckShield for auditing of the BNPL Smart Contract suite

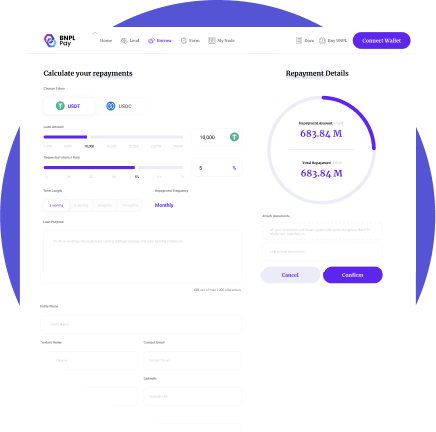

BNPL Pay V1 App Launch

Fully functioning beta release of the BNPL Pay app built for KYC/Non KYC Banking Nodes, Lenders, Borrowers and Stakers with MetaMask integration and base support for Crypto to Fiat conversion via 3rd party partners

Institution Grade Liquidity

A strategic partnership and integration with a leading institution-grade liquidity network to further bridge CeFi to DeFi for both financial institutions and individuals alike

Cross Chain Support

Integration with other Solidity-based chains to reduce transaction fee friction for our Banking Nodes, borrowers, lenders and stakers

ThorFi Specific Product Release

An exclusive collateralized or collateralized lending product for the ThorFi community with ThorFi asset utility

E-commerce specific functionality

Custom development tools including APIs and SDKs for third party corporates to provide direct point of sale financing (BNPL) services to customers

Innovative uncollateralized lending money uncollate ralized lending .

No money upfront. Innovative uncollateralized lend.